As Nigeria’s microfinance sector marks two decades of driving inclusion and transforming lives, Qore, Africa’s leading Fintech Infrastructure and Banking-as-a-Service provider, has announced its role as the headline sponsor of the 20th Anniversary of the National Association of Microfinance Banks.

The partnership underscores Qore’s commitment to powering the next growth phase for microfinance institutions by helping them digitise faster, collect more efficiently, and serve customers better through scalable financial infrastructure and technical support, according to a statement from the firm.

Over the past 20 years, Nigeria’s microfinance institutions have been central to deepening financial inclusion, providing entrepreneurs, small businesses, and low-income households with access to credit and essential financial services.

As the umbrella body for more than 900 licensed microfinance banks across the country, NAMB has led the charge in policy advocacy, capacity building, and collaboration within the subsector.

In line with this milestone, Qore is focusing on practical pathways for microfinance banks eager to modernise their operations — from automating lending processes to offering instant digital financial services that can scale seamlessly across Nigeria’s diverse markets.

With over 15 years of experience in fintech infrastructure, Qore has become an integral player in the country’s digital finance ecosystem. The company currently powers more than 600 financial institutions, processes over 250 million transactions every month, manages N155bn in customer balances, and facilitates N150bn in loans monthly.

Qore’s innovative platforms illustrate its impact and leadership in building Africa’s financial backbone. Its flagship product, BankOne, delivers enterprise-grade extensibility with open APIs and partner integrations that enable microfinance banks to transition from manual processes to agile, digital-first operations.

Related News

Another solution, Recova, automates the entire lending cycle—from loan origination and disbursement to real-time repayment tracking and reporting—enhancing operational transparency and efficiency for financial institutions.

Through Cluster, Qore powers real-time 60-second collection flows on POS devices, simplifying payment management for microfinance banks, agents, and customers. Meanwhile, Pryme offers instant card issuance at branches, vending machines, or as virtual cards, backed by proactive uptime support and strong service-level agreements that guarantee reliability and customer confidence.

Together, these solutions reflect Qore’s mission to build a robust digital backbone that microfinance banks can trust to grow sustainably and competitively in an evolving financial landscape.

Speaking on the partnership, Vice President of Core Banking and Merchant Services at Qore, Patrick Irebo, described the story of microfinance in Nigeria as one of “courage, innovation, and community.”

“For 20 years, NAMB and its members have expanded access to finance for millions of Nigerians,” Irebo said. “At Qore, we are privileged to power the next frontier—helping microfinance banks strengthen their operations, build digital resilience, and continue driving inclusion at scale.”

The NAMB @ 20 celebration, according to organisers, is not just a commemoration but also a platform for reflection, collaboration, and shared purpose in charting the future of inclusive finance in Nigeria. As headline sponsor, Qore will engage directly with industry leaders, share success stories, and showcase how its technology continues to redefine microfinance operations across Africa.

During the event, visitors are invited to book a free 45-minute consultation session or sign a non-binding Letter of Intent at the Qore stand to access a readiness assessment and other exclusive digital transformation offers.

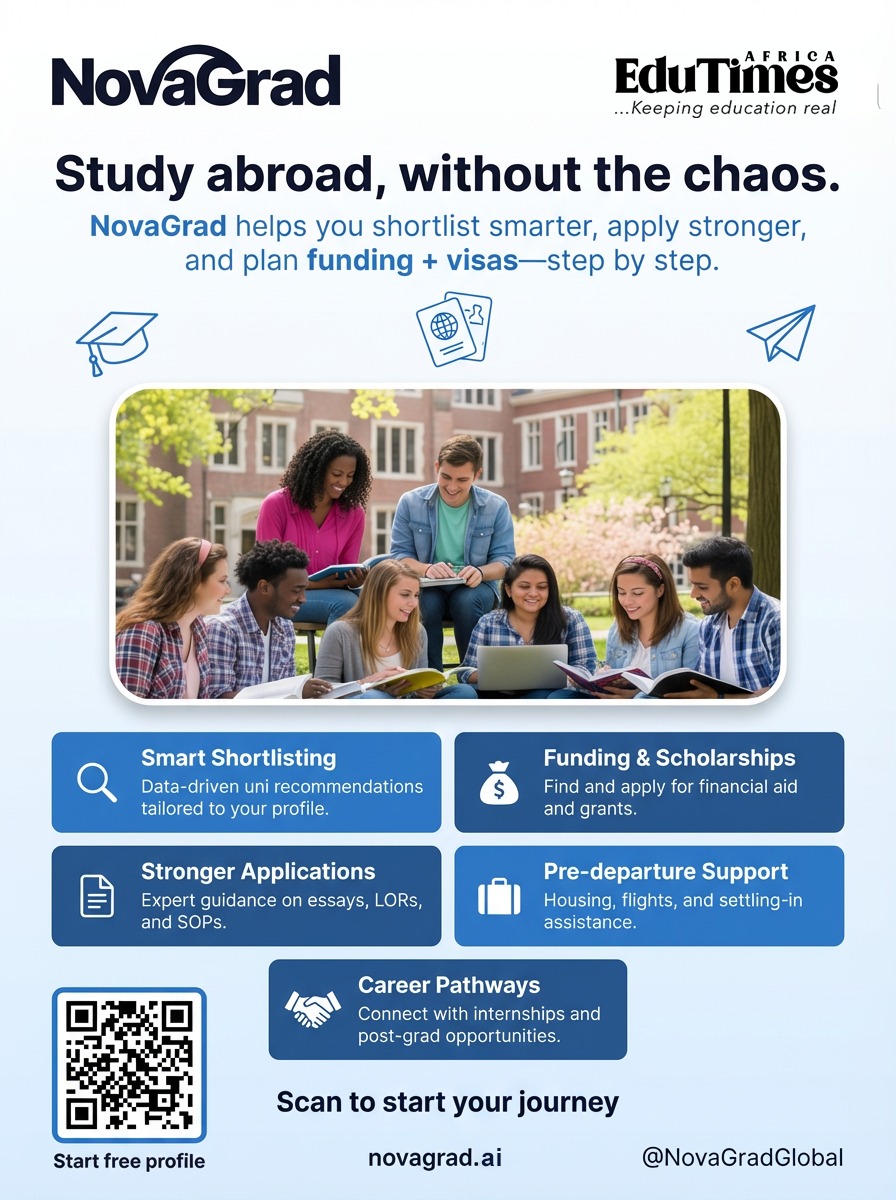

EduTimes Africa, a product of Education Times Africa, is a magazine publication that aims to lend its support to close the yawning gap in Africa's educational development.

EduTimes Africa, a product of Education Times Africa, is a magazine publication that aims to lend its support to close the yawning gap in Africa's educational development.