Mastercard has entered into a strategic collaboration with enza, a payment solutions company, to connect fintech firms across Africa to its network.

Through this partnership, fintech companies are set to be able to develop propositions on the enza platform that provide consumers and businesses with embedded Mastercard payment solutions capabilities. The initiative comes amid a substantial increase in the number of fintech companies operating across Africa, with many focusing their efforts on embedding payment services into broader solutions that support financial access, facilitating alternatives to legacy systems that often present higher costs.

Mastercard solutions for African fintechs

With this collaboration, fintech firms in Africa can access the complete range of Mastercard services. As part of their alliance, Mastercard and enza aim to minimise complexity and expedite time to market for emerging players developing financial solutions throughout the region. Additionally, the agreement will enable enza to host consumer and merchant accounts, manage integration with Mastercard’s network, and ensure security and system availability. Fintechs will be able to configure pre-paid or post-paid accounts, as well as issue physical or virtual Mastercard cards. For businesses, enza will facilitate the acceptance of Mastercard payments across in-store, online, and in-app channels.

Furthermore, commenting on the news, representatives from Mastercard underscored their company’s commitment to advancing the fintech ecosystem by facilitating access to its global network. By collaborating with enza, Mastercard seeks to enable fintech companies in Africa to deploy embedded payment capabilities more efficiently, thus fostering financial inclusion and supporting the region’s digital transformation. Concurrently, enza emphasised that the partnership with Mastercard leverages their existing relationships to better serve the needs of the fintech community.

Latest news from enza

In addition to collaborating with Mastercard, enza also partnered with TerraPay in July 2024 to enhance the payments landscape across Africa. The partnership aimed to address critical issues obstructing business growth in the region and to promote financial inclusion. A primary objective of the collaboration was to transform payment acceptance infrastructures by integrating TerraPay’s connectivity with over 2.1 billion mobile wallets globally.

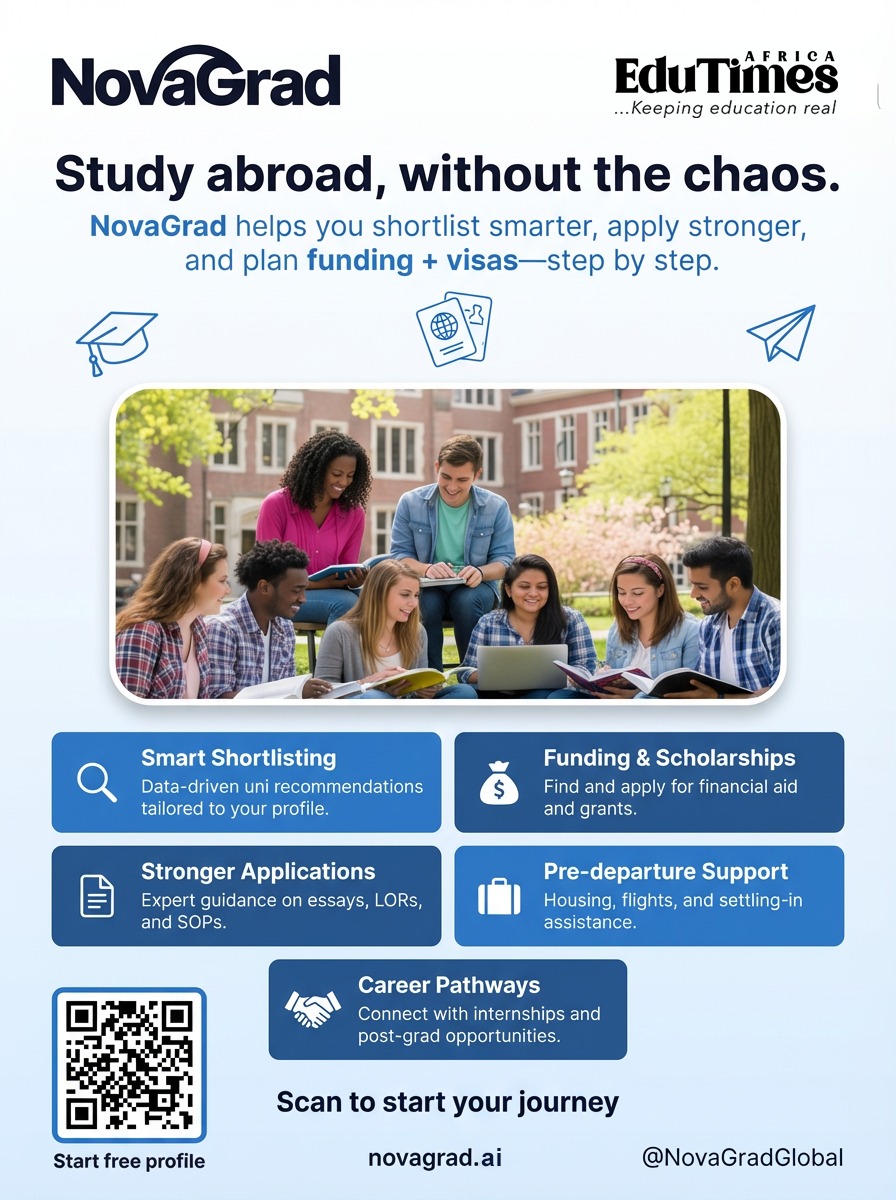

EduTimes Africa, a product of Education Times Africa, is a magazine publication that aims to lend its support to close the yawning gap in Africa's educational development.

EduTimes Africa, a product of Education Times Africa, is a magazine publication that aims to lend its support to close the yawning gap in Africa's educational development.