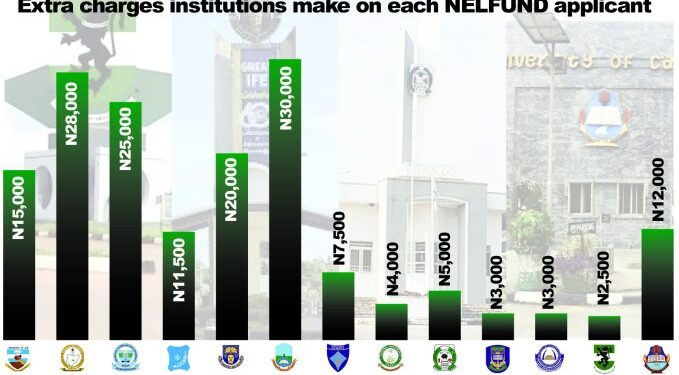

No fewer than 51 public tertiary institutions in Nigeria have been indicted for allegedly making illegal deductions from student loans disbursed by the Nigerian Education Loan Fund (NELFUND).

The Guardian gathered that these institutions charged between N3,500 and N30,000 above the approved institutional fees per student, in violation of the scheme’s guidelines. The schools reportedly received funds from NELFUND on behalf of students but failed to refund excess charges or notify students of disbursements.

Institutions named include Federal University of Technology Akure (FUTA), Modibbo Adama University (MAU), Yaba College of Technology (YABATECH), University of Nigeria Nsukka (UNN), Ahmadu Bello University (ABU), Lagos State University of Education (LASUED), and over 40 others across federal and state universities, polytechnics, and colleges of education.

In a joint statement, NELFUND and the National Orientation Agency (NOA) accused the schools of “deceptive practices” and a lack of transparency, adding that some schools received full payments from NELFUND but still demanded institutional fees from students or added unexplained charges.

At the University of Jos, students were charged between N10,000 and N20,000 more than the N130,000 approved fee. Similar cases were reported at ATBU Bauchi, Federal University Lafia, OAU Ife, and Niger Delta University, among others. In several cases, students who had already paid before NELFUND’s disbursement struggled to obtain refunds.

A student from Taraba State University claimed the school only refunded N57,000 out of N120,000, while the University of Calabar allegedly demanded N12,000 to process a refund invoice. Some students at UNN and UNIJOS said their refund requests have been ignored since January.

FUTA’s spokesperson, Adegbenro Adebanjo, confirmed the double payment issue, explaining that refunds were delayed due to technical challenges in linking a new CBN account to their Remita platform. He assured that reimbursements would be processed in batches.

At MAU, the institution confirmed about 300 affected students, attributing delays to the verification process. YABATECH, on the other hand, denied the allegations, stating that the actual amount received was still under CBN verification.

NELFUND has so far disbursed over N50 billion to about 300 public institutions across the country. However, it warned that several institutions failed to inform students of payments made on their behalf, leading to double payments and confusion.

Managing Director of NELFUND, Akintunde Sawyer, threatened legal action against erring institutions, calling their actions unethical and a violation of the loan scheme’s intent. He noted that if unchecked, such practices could sabotage President Bola Tinubu’s student loan initiative, which was designed to promote access, equity, and fairness in education.

The NOA has also launched an investigation through its community orientation officers, citing cases of universities withholding payments and colluding with banks to delay refunds.

Education stakeholders, including Omole Ibukun of the Creative Change Centre, have called for urgent intervention, saying the scheme—barely a year after its launch—risks becoming a breeding ground for institutional corruption and student hardship.

Analysts have urged NELFUND to consider paying student loans directly to students rather than institutions to curb abuse and ensure greater financial transparency.

EduTimes Africa, a product of Education Times Africa, is a magazine publication that aims to lend its support to close the yawning gap in Africa's educational development.

EduTimes Africa, a product of Education Times Africa, is a magazine publication that aims to lend its support to close the yawning gap in Africa's educational development.