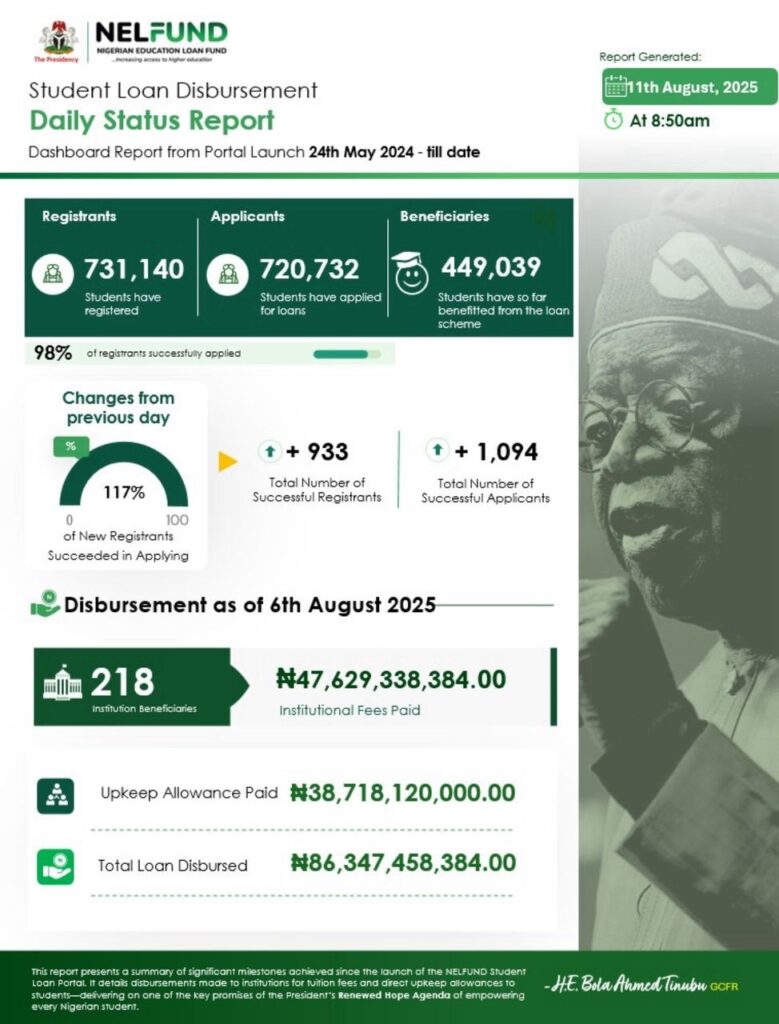

The Nigerian Education Loan Fund (NELFUND) has emerged as a significant force in the nation’s higher education landscape, disbursing ₦86.3 billion in student loans to 449,039 beneficiaries in just over a year of operation.

Since the scheme’s official launch on 24 May 2024, NELFUND has directed ₦47.63 billion to 218 tertiary institutions nationwide to cover tuition fees, while ₦38.72 billion has gone directly to students as upkeep allowances. This two-pronged approach addresses not only the cost of education but also the daily living expenses that often hinder students’ academic progress.

The latest status update, released on Monday, 11 August 2025, reveals impressive uptake: 731,140 students have registered on the portal, with 720,732 successfully applying — a 98 per cent success rate. Daily figures show an average of 933 new successful registrations and 1,094 new loan applications.

Impact on Students and Institutions

For many Nigerian students, NELFUND has been the difference between dropping out and completing their studies. The tuition disbursements have provided universities and polytechnics with a more reliable revenue stream, reducing instances of interrupted academic calendars due to unpaid fees.

At the individual level, upkeep allowances have eased the burden on families grappling with rising living costs. Students have been able to afford accommodation, transportation, and essential study materials, allowing them to focus more on learning rather than survival.

A student at the University of Ibadan, who benefited from the loan, told EduTimes Africa:

“Before NELFUND, I was already thinking of deferring my admission because my parents could not raise my fees. Now, I can pay my tuition and still have money for books and transport.”

The programme has also reduced the stigma around student debt by introducing clear repayment terms that commence only after graduation and employment, encouraging more applicants to come forward.

Driving National Goals

NELFUND states that the initiative is part of President Bola Tinubu’s Renewed Hope Agenda, which prioritises human capital development through education. By expanding access to higher education funding, the scheme aims to increase Nigeria’s graduate output, strengthen workforce readiness, and reduce inequality in educational access.

Experts believe that if sustained, the student loan scheme could bridge the gap between academic potential and financial capacity, ultimately boosting Nigeria’s socio-economic growth.

The Road Ahead

While the early results are promising, stakeholders stress the need for continuous monitoring to prevent misuse, ensure prompt disbursement, and maintain transparent repayment systems. There are also calls for the programme to be extended to vocational and technical training centres, broadening its reach beyond traditional universities and polytechnics.

For now, NELFUND’s first-year impact demonstrates a clear shift in Nigeria’s approach to funding education—from leaving students to struggle on their own to creating structured, large-scale financial support for their academic journey.

EduTimes Africa, a product of Education Times Africa, is a magazine publication that aims to lend its support to close the yawning gap in Africa's educational development.

EduTimes Africa, a product of Education Times Africa, is a magazine publication that aims to lend its support to close the yawning gap in Africa's educational development.